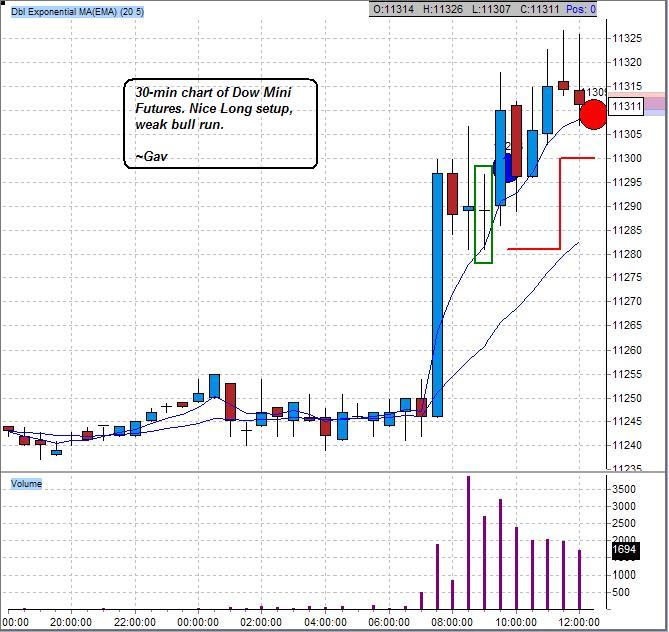

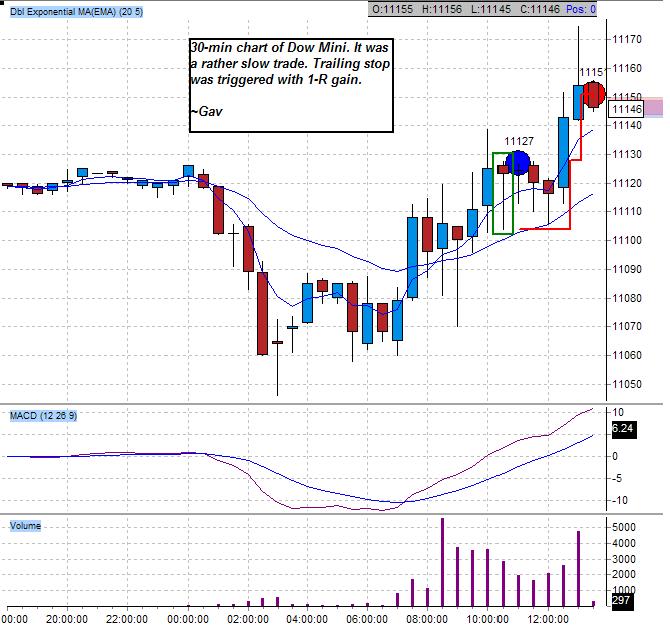

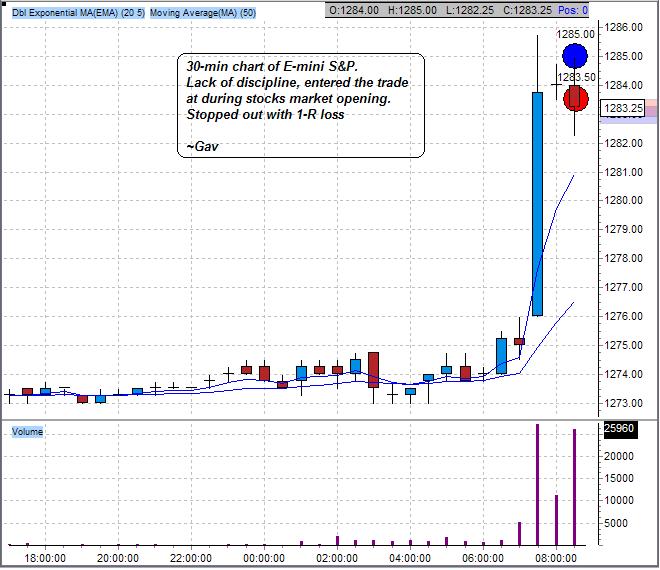

It was another bullish day, and it was indeed a repeat of tuesday’s session. S&P, Dow Mini as well as Nasdaq were having nice dummy set up. Long position of Dow mini was established above 9am(chicago time) candle. It was a very slow trade. Position was closed at 11309, and I have left E-mini Nasdaq position to run instead.That was a wrong exit of Dow. It continued to move up after that. My problem is on Exit a trade (in profit taking way).

[photopress:mini_dow_30_min_trade_close.JPG,full,pp_image]

Here is part of the conversation with my trading buddy Vincent when discussing my problem. I have found it very useful.

do your planning in off hour trading not during trading -” plan the trade and then trade the plan”- if you can’t then you need to do one of 2 things or both – paper trade to give you more confidence so you really believe and therefore will stick to it or work on your discipline by using imagery of how you will trade in all situations or WRITE DOWN your stop and then ask yourself how do I answer to this if I override my stop and if I am wrong in overriding my stop

One trade close with 0.49R gain.