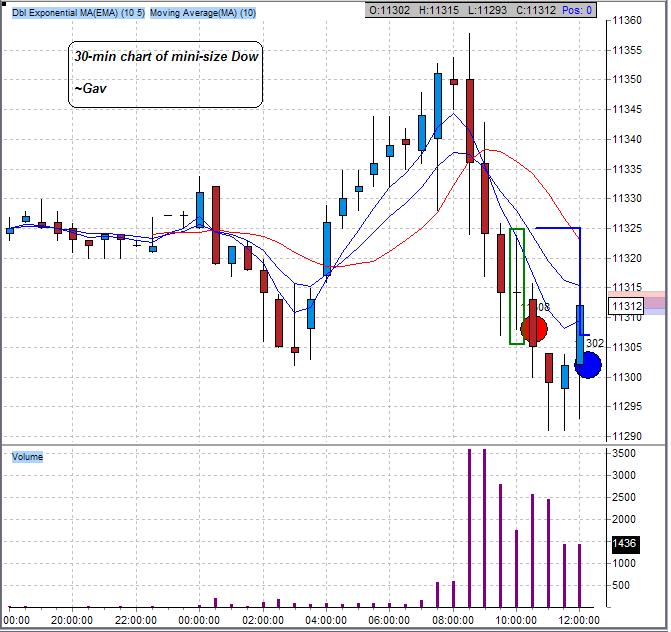

Nothing interesting. No trade was made.

I will not trade on Friday as well. Gotta pack up my luggage and do some planning for my Taiwan trip. ‘Naruwan Taiwan’.

I choose the right time to visitTaiwan.

1. Political instability, people are protesting on the street.

2. Typhoon ‘ShanShan’ approaches Taiwan

3. Earth Quake at Yilan city (Well, this is fine, I can avoid this area)

4. What else?!?!

Looking at the weather forecast, it is going to rain everywhere. Darn, I need some sunlight to bring me hope.

Btw, I have been spending sometime reading blogs these two days. And I revisted Trader-x’s blog. I visited before, but I found the layout was kinda messy, so I did not pay much attention to it. Darn, I guess you know, it is an excellent blog from the X-men! I read again his trades and it really enlightens me. If you have not visited his blog, then go and check it out now.

I know there are some debates of R going on. I am not going to join. I found it useful for my trading, so I use it. If you do not, then leave it.

powered by performancing firefox