So, this is the first post of the year. I am fortunate enough to have my weekly target hit during Tuesday and Wednesday session. And, we are expecting Non Farm Payroll at the end of the week, so I am not opening any new position for the rest of the week.

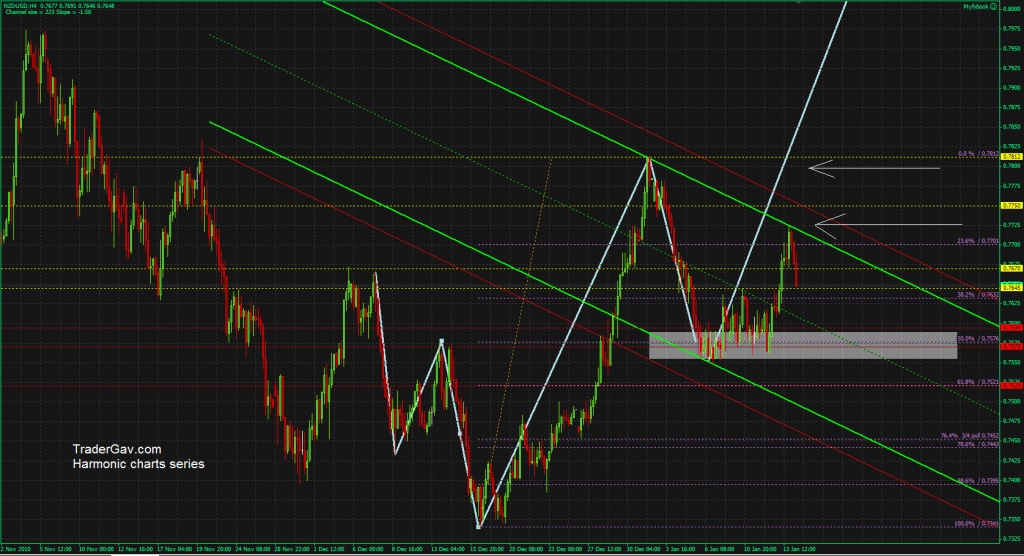

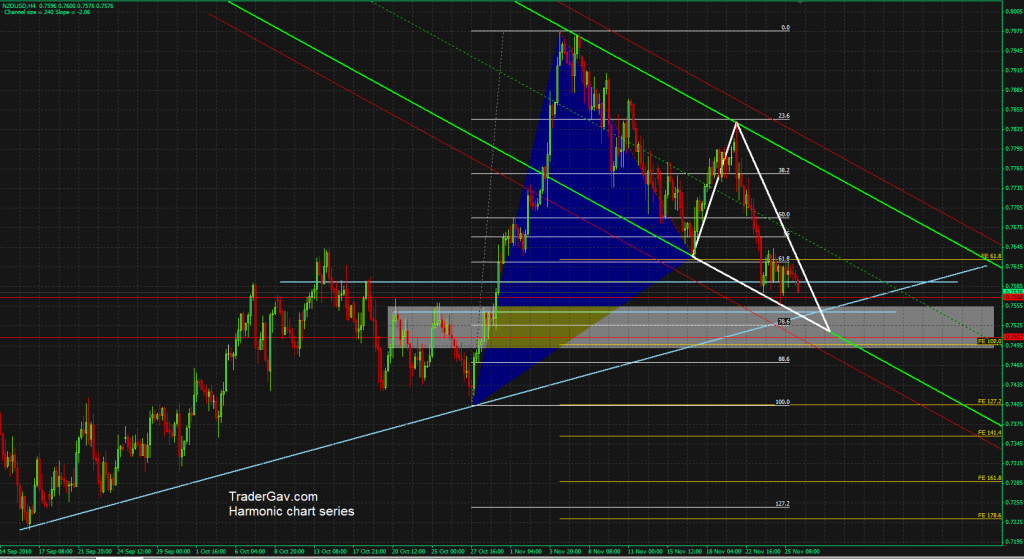

Any of my 12 readers observe the interesting setup forming in NZDUSD? I see a bullish harmonic setup in there. I thought it is not too difficult to see the confluence of Fib levels, support levels and Channel bands.

[tab: Initial Setup]

Here is the CHART!

[tab: Update 14 Jan 2011]

It was indeed a very slow trade. I was paying a lot of attention at the 76 level. It seemed to be bottoming at this level. It was. Kiwi broke out from the range during Thursday session, and first two profit targets were hit. I am now holding the last portion and looking a 78 as next target. Well, let’s see how it goes.

Here is the updated CHART!