This website is free and supported by readers. This post may contain affiliate links. Read the disclosure for more info.

I have been thinking about writing something on money management, I just didn’t know where to start. Of course, I do not claim as an expert on this topic, I am just sharing materials I have learned.

Accuracy vs Risk-Reward Ratio

There are times I read traders’ blog who revealed their risk-reward ratio when making certain trade. Some traders are trading with 1 R in order to earn 0.3R (basically, risking $100 to earn $30, that’s the idea).

There is nothing right or wrong in the trading business, I am not arguing if the trader is doing the right thing. I am interested in looking at some simple mathematical details of this risk plan.

Accuracy or winning rate is the percentage of winning after a serious of trades.

Just how much accuracy is required from your system for you to be profitable after a certain number of trades when you are risking, say, $100 to earn $30 each trade?

Accuracy = (Number of wining trades/Number of losing trades) x 100%

Risk-Reward Ratio is the ratio of the amount you will lose if a trade is stopped out and the profit amount if a winning trade is closed.

Risk-Reward Ratio = $loss/$Win

I found an excellent spreadsheet from Kreslik.com (An excellent forum, with some great traders sharing strategies, programming etc). I have recreated the spreadsheet and it can be found here. moneymanagementchartupload.xls

Feel free to download a copy and play around to get the idea.

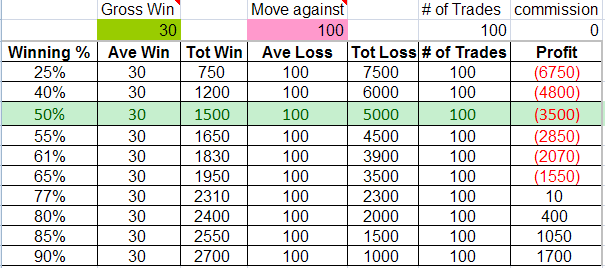

Let’s take an example, risk amount $100, profit target $30.

As you can see, with this risk-reward ratio, you will need a system/methodology that gives 80% accuracy in order for you to be profitable.

A system with over 80% accuracy?

Well, I believe it does exist, but I have no luck to see it so often. Most of the time, I will be happy if my system gives me over 60% accuracy or sometimes, just around 55% accuracy.

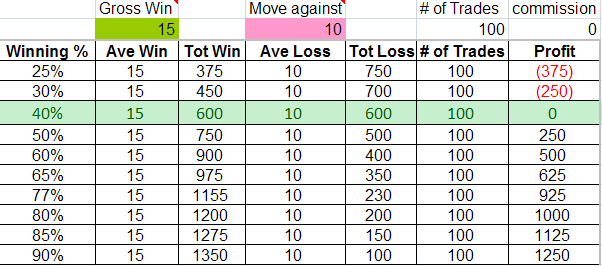

This time, I am risking 1 R in order to earn just 1.5 R (risk $10, to earn $15).

Here is the result.

Basically, it is just like a coin tossing game, I need 50% accuracy in order to be profitable.

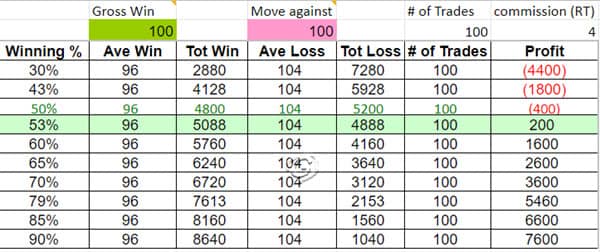

How about risking 1 R to earn 1 R?

Not a good idea. Remember, commission kills.

For example, we assume each trade, $4 is required for the round-turn commission. With a 1:1 risk-reward ratio, over 100 trades, we are still at the losing end, if our system is unable to produce 53% accuracy.

You can try out different Risk/Reward combinations in the spreadsheet.

Accuracy vs Risk-Reward Ratio – Final Words

Some simple calculations do help traders to understand the nature of trading. It is crucial to have a good understanding of these concepts between you start trading.

Trading is a long game. Having a good understanding of risk management will go a long way.

If you think it is ok to risk bigger dollars to earn a small profit, make sure you have a high accuracy system that pays you.

Tool I use

The Advanced Calculator from Forex Smart Tools is one of the best retail money management tools I have used. It helps to calculate and fine-tune my overall risk plan before I put on a trade.

It is a robust tool that caters to different trading styles including cost-averaging, stop-and-reverse, and multi-leg positions, etc.

If you are interested in finding more about the journaling tools I use in my trading, check out the resource page for more details.

What is your winning rate and risk-reward ratio in your trading? Which money management tool do you use for your trading?

Do you have any questions or comments? Please feel free to drop me a line in the comment section. I am happy to help.

Good stuff. Here’s another way to look at it using a randomizer that can generate multiple equity lines to simulate returns for user input of risk:reward and win rates combinations.

http://hquotes.com/tradehard/simulator.html

Good stuff. Here’s another way to look at it using a randomizer that can generate multiple equity lines to simulate returns for user input of risk:reward and win rates combinations.

http://hquotes.com/tradehard/simulator.html

Eyal: Thanks for the link.:)

Eyal: Thanks for the link.:)

this is good site I am trading in indian stock market, as experince here indian stock market with high risk trading but reward too high , how to minimise risks any tips ?

thank you

Tiger

this is good site I am trading in indian stock market, as experince here indian stock market with high risk trading but reward too high , how to minimise risks any tips ?

thank you

Tiger