Here is a quick review of YM for the past day. Since the principle of these trades are closed to Dummy trading , which is “To limit risk by better market timing”, I categorize this series of post under Dummy Collection.

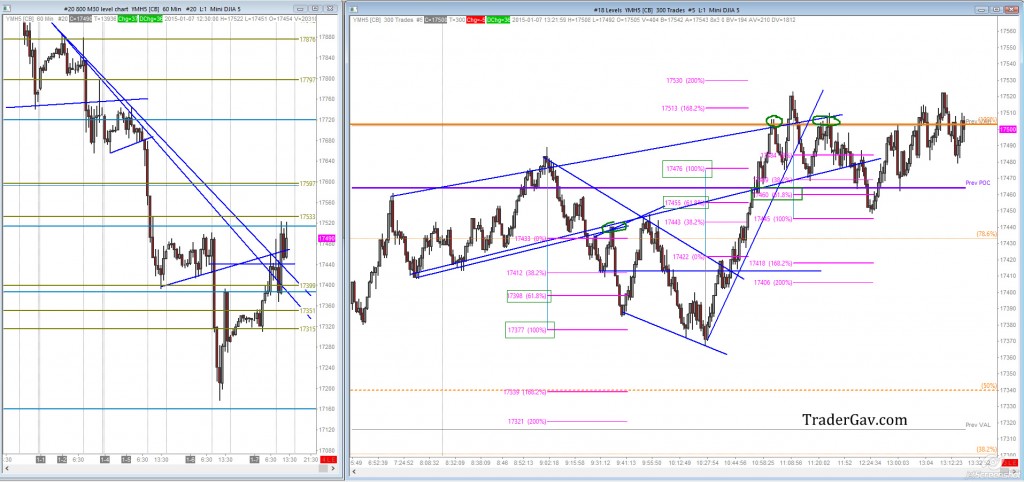

Looking at the context, the hourly chart at the right, downtrend is clearly observed. One interesting point is the V-shaped reversal from 17200. I expect the high/source of previous supply 17502 to be tested. I don’t immediately fade these supply , demand zone, instead, I prefer to see price trade into them and decide the next step of action.

There were a couple of trading opportunities appeared in yesterday’s session.

First one was the break and retest of the uptrend line, which was around 17433. This is a mean reversion trade for me. YM traded above current day’s developing value area, and auctioned back into value area of the day. I expected the day’s developing value (VWAP, not shown in the chart) around 17398 to be tested, in other words, I expect YM to, at least, trade into VWAP from here.

Second setup was when YM went back up to yesterday’s RTH high. A break of uptrend line with over-and-under pattern (credit to Steve W from NoBrainerTrades for this concept) form at this point. A short at the retest 17502, with target back into the day’s developing value area, confluence with 1.618 measured move target around 17460.

Those were two obvious trade opportunities I found yesterday in between ADP release and FOMC meeting minutes.

Have a good day.

Leave a Reply